The path from a start up to a well-known and prosperous business is paved with challenges. Convincing investors that your business is worth investing in is one of the biggest challenges new businesses face. Unfortunately, some companies fail to secure funding and must finance their business from their own funds.

We will discuss the reasons why businesses might be rejected by potential investors and how to find investors for a start up.

Why investors reject startups

Lack of a clear business model

Investors want to understand how a start up expects to generate money. If the income sources are unclear or the company strategy appears unsustainable, investors are likely to pass.

Start ups must present a clear and appealing business model outlining how they intend to generate income. This involves identifying target clients, analysing their needs, and developing a monetisation plan. Without a defined plan, investors may view the start up as a risky investment.

Inadequate market research

You should know your position from head to toe. A good idea and the desire to launch a prospective company are not enough. Investors need metrics and figures that demonstrate how they'll get more money while partnering with you.

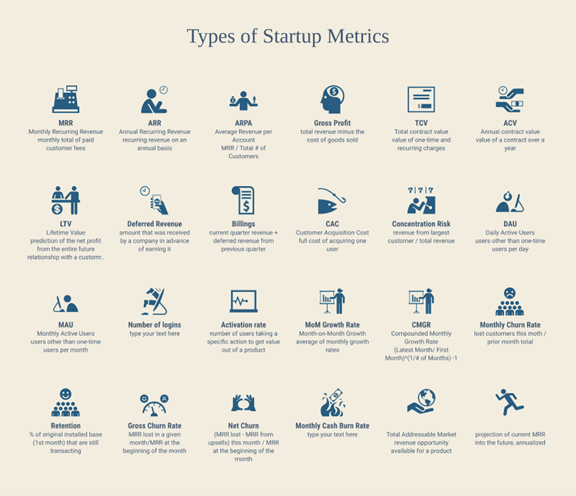

Pay attention to business metrics and be ready to answer an investor's concerns and questions. The most important metrics include:

- MRR (monthly recurring revenue)

- Burn rate (cash spending rate)

- CAC (customer acquisition cost)

- LTV (lifetime value)

- Churn rate (customer attrition rate)

Other start-up metrics

source: adioma.com

Weak team

A strong start up team is really important. Investors will look for a strong, unified workforce with the abilities and expertise required to deliver the company's strategy. If the team seems inexperienced or lacks critical skills, this will raise red flags.

A start up's personnel should have a blend of technical expertise, industry experience, and business savvy. Highlighting the team's previous triumphs and related experience helps increase investor trust. In contrast, a team with deficiencies in critical areas may cause investors to doubt the start up's capacity to deliver on its claims.

Unrealistic and overly optimistic financial projections

Financial estimates that are either too optimistic or too unclear might put investors off. People prefer realistic, data-driven projections over bold but unverified assertions. Overestimating the market size or underestimating costs might make an investor question the founder's commercial competence.

Accurate financial estimates should be based on reliable data and acceptable assumptions. This contains revenue projections, cost estimations, and profit timelines.

Weak pitch

A pitch might miss the mark when it comes to explaining the potential and feasibility of the business, even with a strong business idea. Investors may quickly lose interest in a pitch if it fails to clearly express the problem, solution, market opportunity, and financial potential. Furthermore, failing to address important issues or provide insightful answers to pertinent queries might erode investors' faith in the founders' abilities.

Entrepreneurs need to create a pitch that is captivating and well-structured to prevent this. This means putting in a lot of work, foreseeing possible queries, and putting together comprehensive answers.

Structure of a pitch presentation

- Introduction. Give a succinct overview of your business and yourself to start. Add your name, title, and a succinct synopsis of your company.

- Problem description. Clearly state the issue that your item or service attempts to resolve. To demonstrate the importance of the issue, use facts or stories.

- Solution. Offer your goods or services as a remedy. Describe how it solves the issue and draw attention to any special qualities or benefits.

- Market opportunity. Make an overview of your target market. Show that there is a substantial and growing demand for your solution.

- Business model. Explain how your company makes money. Outline your revenue streams, pricing strategy, and any key partnerships.

- Traction. Share evidence of your company's progress. This can include customer testimonials, sales figures, user growth, and any significant milestones achieved.

- Competitive analysis. Identify your main competitors and explain why you can withstand the competition with your out-of-the-box solution.

- Financial projections. Provide a summary of your financial projections. Include revenue forecasts, expense estimates, and break-even analysis.

- Funding requirements. Clearly state the amount of funding your start up needs and how you plan to use the investment. Be specific about your needs and goals.

- Conclusion. End with a strong conclusion. Summarise the key points, reiterate your ask, and invite questions. Express your enthusiasm and confidence in your business.

TIP: Be ready to answer any follow-up questions. Your market size, competitive edge, revenue model, financial predictions, and expansion strategy are all potential questions for investors. To establish a closer bond, some people might even wish to know more about you. No matter what questions investors ask, be sincere in your answers.

Useful funding platforms for start ups

Here are some of the top places for contacting potential investors:

- AngelList. This is a job-seeker network for connecting investors with companies. Here, you can find venture capitalists and angels to gain start up capital.

- Crunchbase. This platform has a comprehensive database that provides information on firms, including past investment activity.

- SeedInvest. This is one of the top platforms for equity crowdfunding to raise capital from certified investors.

- Kickstarter. A well-known platform to show off your idea to a large audience and get money.

- Gust. This platform is designed to facilitate seed and early-stage financing. Gust connects entrepreneurs with a global pool of certified investors.

- LinkedIn. This social media platform lets you network with investors, even though it's mostly used for sharing professional insights.

Work on your business and your presentation. Even the most prospective idea will fall short if you bungle your pitch and don't prepare beforehand. By using this guide, you'll be more prepared and have a better chance of getting the money your start-up needs.

Copyright 2024. Article made possible by Purrweb .